What was the record high WMC historical earnings result?

In terms of earnings or revenue, what is the best WMC historical earnings result that Western Asset Mortgage has ever posted, and when?

✔️Accepted answer:

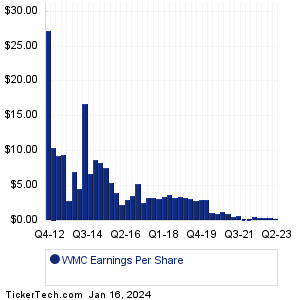

Within our data set, the highest WMC historical earnings result was set in Q3 2012, when Western Asset Mortgage posted results of 27.200/share. The most successful revenue quarter within our data set was Q2 2015 when Western Asset Mortgage reported revenue of 34.45M.

What was the lowest Western Asset Mortgage historical earnings result?

In terms of top line revenue or bottom line earnings per share, what was the lowest WMC has reported, and when?

✔️Accepted answer:

Within our data set, the lowest WMC historical earnings result was set in Q1 2022, when Western Asset Mortgage posted results of 0.100/share. The smallest revenue quarter within our data set was Q2 2023 when Western Asset Mortgage reported revenue of 0.00B.

On this page we presented the WMC historical earnings date information for Western Asset Mortgage. Reviewing that

Western Asset Mortgage Historical Earnings for the company, we see that the highest historical earnings result in our data set was in Q3 2012, when WMC posted adjusted EPS of 27.200/share. Meanwhile the lowest WMC historical earnings result was in Q1 2022, when WMC posted adjusted EPS of 0.100/share. Moving to Western Asset Mortgages historical revenue numbers, the largest revenue quarter in our data set was seen in Q2 2015 when WMC reported 34.45M in revenue, while the smallest revenue quarter was Q2 2023 when WMC reported 0.00B in revenue.

For self directed investors doing their due diligence on WMC or any other given stock, their research can benefit from

looking into all of the Western Asset Mortgage historical earnings in our data set presented side by side

on one page for ease of comparison. Reviewing this historical EPS information can help when projecting future earnings per share,

as well as providing important context for pondering whether the historical earnings trajectory justifies the current stock value or not.

That's why we bring you

HistoricalEarnings.com to make it more convenient for investors to look into

Western Asset Mortgage historical earnings, or the historical earnings information for any stock in our coverage universe.

In your continued due diligence investigations, we hope you check out the further links included for historical PE studies, earnings

surprises history as well as next earnings dates for WMC. Thanks for visiting, and the next

time you need to research

WMC historical earnings or those of another stock, we hope our site will come to your mind

as your preferred historical earnings, revenue, and EPS research resource of choice.